Tariffs on lumber and wood imports are piling pressure on an already unaffordable housing market. Builders now face surging material costs, tighter margins, and delayed projects. If we don’t act fast, affordability could crumble further. The good news? There are smart supply-side solutions that can help us fight back.

The 2025 lumber tariffs — targeting timber, cabinetry, and furniture imports — are increasing construction and renovation costs, worsening affordability in the U.S. housing market. Builders are feeling squeezed as project budgets tighten and procurement delays rise. Affected products include Canadian lumber and components crucial to residential builds. To counter these pressures, builders should explore factory partnerships and streamline their procurement supply chains for efficiency and cost control.

Let’s unpack how these tariffs are impacting our industry and what strategies builders can use to maintain profitability and delivery timelines despite rising material costs.

How Will New Lumber Tariffs Affect the Housing Market?

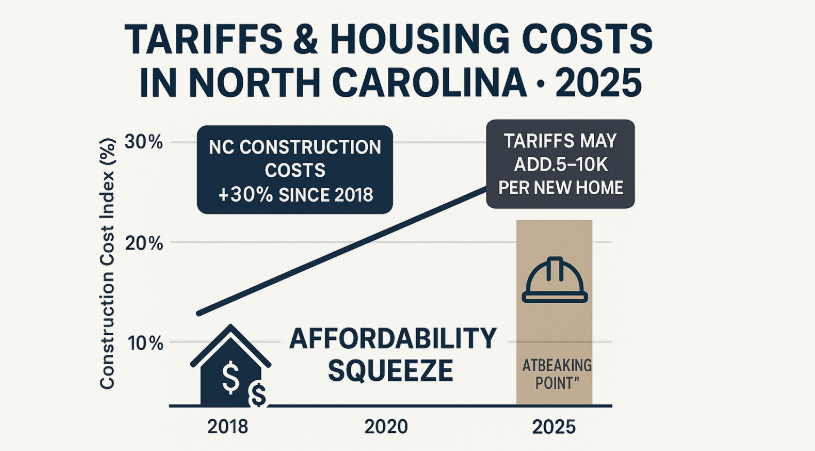

The U.S. housing market is already struggling with low inventory, high interest rates, and slowed construction. Now, new tariffs under Section 232 — justified by national security — are raising the cost of imported timber, cabinetry, furniture, and related wood products.

According to the National Association of Home Builders (NAHB), this move creates “additional headwinds” for builders already grappling with tight margins. The average single-family home could see material cost increases ranging from $5,000 to $12,000, depending on the region and scale of construction.

What’s especially troubling is that this tariff comes at a time when the Fed is signaling rate stability or slight cuts, which should ideally spur new home construction. Instead, builders are hesitant to break ground on new projects due to supply cost uncertainty.

What Products Are Affected by the 2025 Lumber Tariffs?

The tariffs specifically apply to a wide range of construction materials and finishes, including:

- Raw timber and finished lumber

- Canadian softwood lumber (a major source for U.S. builders)

- Kitchen and bathroom cabinets

- Vanities and storage units

- Furniture-grade wood materials

- Flooring components and engineered wood panels

This affects both the structural core and finishing touches of a build. The cost of essential materials like framing lumber and cabinet-grade plywood is rising, creating volatility in builder quotes and material orders.

As a result, many small- and mid-size builders are reporting 2–3 week project delays, especially for homes with custom cabinetry or imported interior components.

How Are Cabinet and Furniture Tariffs Linked to Housing Costs?

While the spotlight is on lumber, furniture and cabinetry are often overlooked culprits in rising build costs. The new Trump tariffs on cabinets, vanities, and finished furniture can add thousands of dollars to the final fit-out cost of a new home.

For mid-range to high-end developments, custom or imported cabinets can represent 10–15% of total interior finish budgets. With these tariffs, builders are forced to choose between price hikes, redesign, or absorbing the cost.

Additionally, many builders who source prefab vanity units or flat-pack cabinetry from overseas are now dealing with customs delays and unpredictable pricing, especially on shipments from Asia and Canada.

Can Builders Offset Costs Caused by Lumber Tariffs?

Yes — but it requires proactive supply chain management and strong industry partnerships. Here are three strategies that forward-thinking builders are already exploring:

1. Collaborate With Offsite/Modular Factories

By shifting some work to modular building factories, builders can reduce on-site labor dependency and secure bulk material pricing through factory procurement systems. Many of these factories have preferred vendor contracts that help buffer against tariff-induced price spikes.

According to NAHB research, offsite collaboration reduces waste, shortens delivery timelines, and helps stabilize material costs in volatile markets.

2. Establish Regional Supplier Pools

Instead of relying on national distributors, consider regional procurement pools or co-ops with other builders. Buying in bulk through shared supply channels can unlock better pricing and reduce freight costs.

3. Redesign for Cost Efficiency

Simple design changes — like choosing stock cabinet sizes or using alternative materials for trim — can dramatically reduce material exposure to tariffed imports. Builders should work closely with architects and designers to value-engineer plans without compromising style.

Factory Partnerships: Can Offsite Collaboration Improve Cost Control?

Absolutely. Offsite manufacturing is no longer just a “tech trend” — it’s becoming a lifeline for builders looking to cut costs and manage risk.

By partnering with modular construction factories or component assembly plants, builders can:

- Lock in fixed-price material packages

- Reduce on-site waste by up to 40%

- Improve timeline predictability with just-in-time delivery

Some builders are even co-investing in shared factory space or entering long-term purchasing agreements with suppliers who have domestic production capabilities.

NAHB recommends evaluating regional offsite providers for foundational components like roof trusses, wall panels, and cabinetry frames that would otherwise be subject to tariffs.

Streamlining Procurement: How Builders Can Gain Supply Chain Advantage

Procurement is where smart builders will win or lose in this new tariff environment.

Here are four procurement tactics builders should implement immediately:

- Pre-Buying Key Materials Secure non-tariffed or lower-cost goods now for Q1–Q2 2026 builds.

- Build Local Supplier Relationships Domestic suppliers with stable inventories can offer better delivery timelines and more flexible terms.

- Negotiate Tiered Contracts Lock in pricing for multi-home builds or subdivision phases. Suppliers may agree to volume-based discounting.

- Track Tariff Timelines Stay updated on trade negotiation developments. Some tariffs may be temporary or adjusted based on political shifts or legal challenges.

Pro tip: Join your local builder association to stay updated on procurement strategies others are using to navigate these changes.

Summary

Lumber tariffs are reshaping how builders approach costs and planning. But with smart sourcing and collaboration, we can stay ahead. Let us know: how are you adapting to these changes? Share your strategies in the comments or connect with us to exchange insights and solutions.