Rising global demand, unpredictable supply chains, and material shortages are pushing construction input costs to historic highs. Among the many materials affected, engineered wood products like MDF, particle board, and plywood stand out. But which of these is the most volatile in pricing — and how can buyers plan accordingly? This article breaks it all down, helping your business stay ahead of market swings.

Among MDF, particle board, and plywood, plywood is the most affected by raw material price fluctuations. Plywood relies on whole logs — whose prices are often unstable — while MDF and particle board use recycled fibers and wood chips, making them less volatile. The need for high-grade veneers and larger log sizes also raises plywood’s price sensitivity to timber market shifts.

To understand why plywood leads in pricing volatility, let’s explore the materials’ core composition, supply challenges, and market behavior.

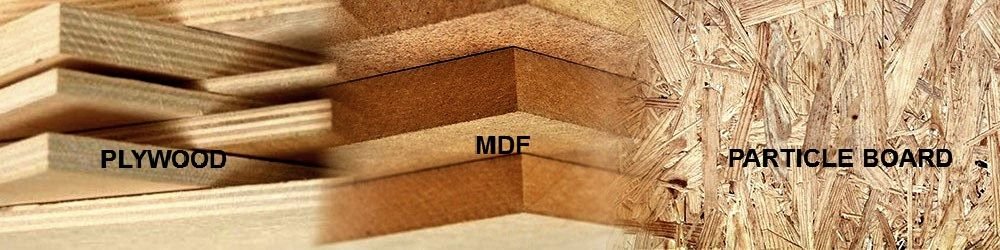

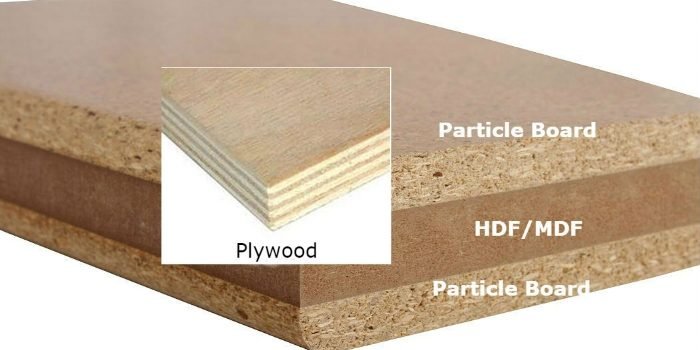

Raw Material Composition: Plywood vs MDF vs Particle Board

Understanding what goes into each panel type is the key to predicting its sensitivity to raw material cost changes.

MDF (Medium-Density Fiberboard)

MDF is made from fine wood fibers — usually byproducts like sawdust and softwood chips — mixed with urea-formaldehyde or other resins.

- Main inputs: Wood fibers (small-scale waste), glue/resins

- Chemical content: High — resins form a significant portion of the cost

- Wood dependency: Low — does not require whole wood

Particle Board

Like MDF, particle board is manufactured using wood residues such as chips, shavings, and sawdust. These are compressed with glue into sheets.

- Main inputs: Wood particles, adhesives

- Chemical content: Moderate — glue is essential but used in smaller quantities than MDF

- Wood dependency: Low — fully based on scrap/recycled materials

Plywood

Plywood is constructed by layering and gluing together thin veneers peeled directly from logs. These veneers are laid in alternating directions to increase strength.

- Main inputs: Full wood logs, formaldehyde-based glue

- Chemical content: Low to moderate

- Wood dependency: High — quality, size, and consistency of logs critically affect both production and cost

Key Takeaway:

- Plywood is the only one that relies on “whole wood,” making it more sensitive to fluctuations in timber and log prices.

- MDF and particle board, being made from waste material and resins, are more stable, but resin prices can also rise with chemical commodity markets.

Factors Affecting Raw Material Prices

The pricing of MDF, particle board, and plywood is shaped by a complex mix of factors. Here’s what influences their raw material costs the most:

Volatility of Raw Inputs

- Plywood: Vulnerable to timber export bans, forestry regulations, logging restrictions, and species shortages.

- MDF & Particle Board: Impacted more by global oil and chemical markets, since resins are petroleum-based.

Supply Chain Dependency & Geography

- Plywood production depends heavily on timber-rich regions.

- MDF and particle board can be locally sourced due to flexible input requirements, making them less susceptible to cross-border shipping issues.

Manufacturing Process & Substitution Possibility

- Plywood: Low substitution flexibility due to strength and structural use cases.

- MDF & Particle Board: Often interchangeable in furniture and interior decor, making them more adaptable to price changes.

Final Product Price Transmission to Buyers

Price changes in these materials don’t just affect suppliers — they ripple through to final products like furniture, cabinets, and doors.

Direct Price Transmission

- Plywood: High. Since it’s used in visible, load-bearing applications, price hikes directly affect construction and custom furniture pricing.

- MDF: Moderate. Price increases are usually absorbed or compensated with design changes.

- Particle Board: Low. Often used in budget interiors and packaging, the price shift is minor unless glue prices spike.

Customer Sensitivity

- Furniture manufacturers are highly sensitive to MDF price changes, as it’s used for painted or laminated surfaces.

- Homeowners and developers often react to plywood price changes, especially in cabinetry and joinery.

How Can Companies Minimize Cost Risk in Material Selection?

Cost unpredictability can disrupt your entire procurement pipeline. Here’s how to reduce exposure:

- Use MDF or particle board where structural integrity is not essential

- Lock in supplier contracts with quarterly or yearly pricing

- Monitor global oil prices and forestry policies to anticipate glue or timber surges

- Work with manufacturers offering alternative board grades (e.g. HDF, OSB, LVL)

- Diversify sources across regions (avoid dependence on one timber-exporting country)

At UWG, We Help You Minimize Material Cost Fluctuations With:

Stable, diversified raw material sourcing Our supply chain is built for resilience and uninterrupted delivery, supported by strong raw material inventory and warehousing.

Wide selection of board types: MDF, PB, HDF, and premium plywood — plus solid wood options to meet diverse application needs.

Eco-certifications: All materials meet FSC and CARB Phase II standards, supporting your sustainability commitments.

High-grade material options Whether you need structural strength or flawless finishes, we offer boards tailored for performance and aesthetics.

Transparent pricing and contract support Our flexible agreements and pricing transparency help you control costs — even when the market fluctuates.

Summary

Plywood is the most sensitive to raw material price spikes due to its reliance on high-grade logs and low substitution flexibility. In contrast, MDF and particle board offer more pricing stability through their use of recycled inputs and resins.

Enterprises should not only choose stable material suppliers but also focus on adopting sustainable practices, building agile supply chains, and finding effective strategies to manage the impact of raw material cost increases on procurement. Strengthening internal risk control systems is essential to stay competitive in volatile markets.